Home insurance is an essential investment for every homeowner, providing vital protection for one of your most significant assets. This type of insurance covers damage to your home and personal property from various risks, including fire, theft, and natural disasters. With the unpredictability of life, having a reliable policy can offer peace of mind and financial security.

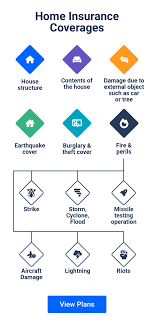

When selecting home insurance, it’s important to understand the different types of coverage available. Standard policies typically include dwelling coverage, which protects the structure of your home, and personal property coverage, safeguarding your belongings. Liability coverage is another crucial aspect, as it protects you in case someone is injured on your property and decides to sue. Additionally, consider optional endorsements or riders that can enhance your policy, such as coverage for valuable items like jewelry or art.

Cost is often a primary concern for homeowners. Several factors influence home insurance premiums, including the location of your home, its age, and your claims history. To find the best rate, it’s advisable to shop around and compare quotes from different insurers. Many companies offer discounts for bundling home insurance with auto or other policies, which can significantly reduce your overall costs.

Another key consideration is the claims process. In the event of damage, understanding how to file a claim and what documentation is needed can streamline the process and reduce stress. Keeping an inventory of your belongings and taking photos of your home can help expedite claims and ensure you receive the compensation you’re entitled to.

Ultimately, this is not just about protecting your property; it’s about safeguarding your financial future. By choosing the right policy and understanding your coverage options, you can navigate the uncertainties of homeownership with confidence. Investing in a solid home insurance plan ensures that you’re prepared for unexpected events, allowing you to focus on enjoying your home rather than worrying about what might happen next.