Motor insurance is a specialized form of coverage designed to protect vehicle owners from financial losses resulting from accidents, theft, and other unforeseen events. It is not only a legal requirement in many regions but also a vital component of responsible vehicle ownership. At its core, motor insurance provides two main types of coverage: liability and property damage. Liability coverage protects the insured from financial responsibility if they are found at fault in an accident that causes injury or damage to others. Property damage coverage helps pay for repairs or replacement of the insured vehicle in case of accidents, theft, or vandalism.

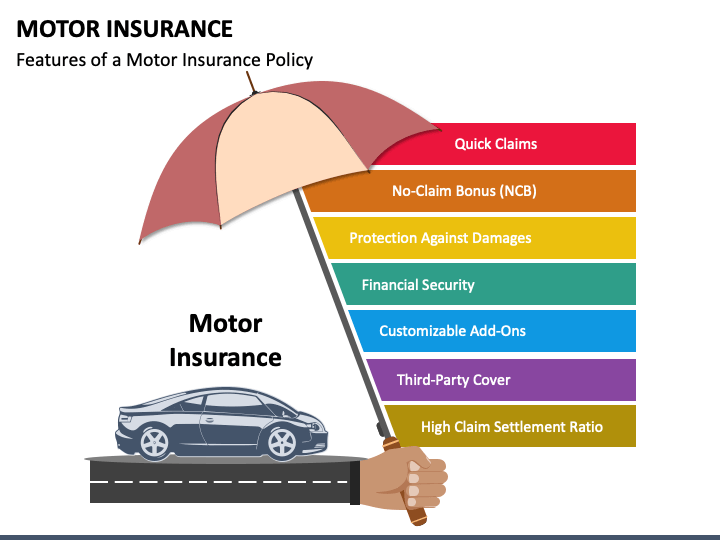

Motor insurance policies can vary significantly, allowing policyholders to choose options that best suit their needs. Comprehensive coverage, for instance, extends beyond just accidents, covering incidents like natural disasters, fire, and even animal collisions. Conversely, third-party insurance, often mandated by law, covers only damages inflicted on others, making it the minimum required for legal driving.

Moreover, it can include additional features such as personal accident coverage, which offers protection for the driver and passengers in case of injuries sustained during an accident. Some policies even provide roadside assistance, ensuring help is available in emergencies like breakdowns or flat tires.

Understanding motor insurance is crucial for drivers, as it not only safeguards against financial setbacks but also contributes to overall road safety. With the rising number of vehicles on the road, having adequate motor insurance is essential for minimizing risks and ensuring peace of mind while driving. Ultimately, it fosters a sense of responsibility and security, enabling individuals to navigate the complexities of modern transportation with confidence.